What I Read This Week (3/25/25)

Michelangelo on Mastery, Humanoid Robot Manufacturing is Here, Fed Holds Rates & Slows QT, Final Classroom Move, Taking it Slow for Spring Break

Every week, I like to share what caught my attention. This is from 3/16/25 to 3/25/25.

Timeless Idea💡

“If people knew how hard I had to work to gain my mastery, it would not seem so wonderful at all.” - Michelangelo Buonarroti

Michelangelo is best known for his sculptures, paintings, and architecture—the Sistine Chapel ceiling, the David statue, and St. Peter’s Basilica—big, breathtaking stuff.

But we forget this: making them took him a lifetime of work.

Masterpieces look magical. But they come from grinding effort. Quiet hours. Missed dinners. Countless redos.

I think about that a lot when people compliment the things I make.

Sometimes, I’m lucky enough to hear, “Wow, that’s impressive!” And I smile, but a part of me laughs because if they knew how many drafts I wrote, how long I stared at blank screens, how many times I almost gave up… they might not say it was impressive. Honestly, they might wonder why it isn’t better after all that effort.

But that’s the thing.

The work is the wonder.

The finished product gets the applause, but it's the hours behind the curtain—those unglamorous, stubborn, faithful hours—that make it possible.

If you’re in the middle of your own long, slow project: keep going. You’re not behind. You’re just doing what all the greats did.

Even Michelangelo.

Sometimes, I have to remind myself of this.

New Idea 🌟

Figure Announces BotQ: High Volume Robot Manufacturing Facility

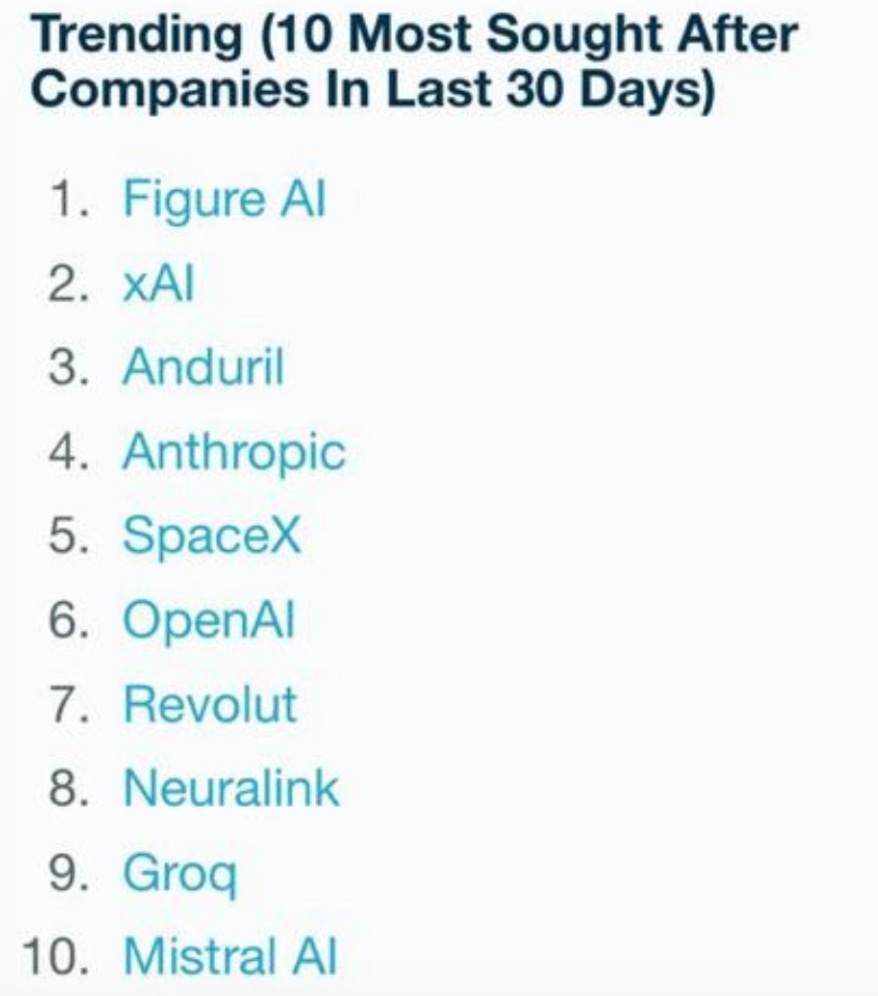

Figure has recently become the most sought-after private company for investors. That is not surprising, considering they are the front runners (in my opinion) in the Year of the Robot.

Recently, they announced their BotQ, a headquarters for manufacturing large numbers of robots. It can make 12,000 robots annually and aims to hit 100,000 in four years. These robots will help with jobs like factory work, shipping, and maybe even chores at home.

BotQ builds almost everything itself, from motors to batteries, and even uses Figure’s own robots to help make more robots. They’ve got smart software to track every part and make sure everything runs smoothly. The new Figure 03 robot will be cheaper and quicker to produce, thanks to faster methods like molding instead of slow machining.

Located in San Jose, BotQ is Figure’s big step toward making humanoid robots common—and they plan to open more factories soon. They also have backing from big players like Jeff Bezos and is valued at $2.6 billion. The founder has openly stated that no amount of money will get him to sell this company— I think this company has the makings to be an American powerhouse.

Here is a video that shows part of the process:

You can also check out more on Figure here. Today, they announced that their robots could now walk naturally like humans.

What I See In Markets 📈

Fed’s Latest Move: Rates Steady, QT Slows Down

The Federal Reserve’s FOMC met on March 18-19, 2025, and decided to keep interest rates steady while changing its plans for Quantitative Tightening (QT).

No Change in Interest Rates

Current Rate: The federal funds rate stays at 4.25% to 4.50%, unchanged from the last meeting. After cutting rates by a full percentage point in late 2024, the Fed is hitting pause to watch how the economy reacts.

Future Cuts: The SEP’s “dot plot” shows the Fed still expects two rate cuts in 2025, dropping the rate to around 3.75% to 4.00% by year-end. That’s a total of 50 basis points (0.50%). However, fewer members now predict more than two cuts compared to December, signaling caution.

Slowing Quantitative Tightening (QT)

What’s QT? It’s the Fed’s process of shrinking its balance sheet by letting Treasury securities roll off without reinvesting the proceeds. Basically, they are taking money out of the economy.

New Plan: Starting in April 2025, the Fed will slow QT, reducing the monthly cap on Treasury redemptions from $25 billion to $5 billion. That’s an 80% cut in the runoff pace, leaving more cash in the system to ease market pressure.

Why Slow Down? The Fed wants to avoid stressing the Treasury market while keeping inflation in check. One member, Christopher Waller, dissented, preferring to stick with the faster $25 billion pace.

Key Numbers from SEP

Growth: The Fed lowered its 2025 GDP growth forecast to 1.7%, down from 2.1% in December 2024. Slower growth ahead :(

Inflation: Core PCE inflation (the Fed’s favorite measure) is expected to hit 2.8% in 2025, up from 2.5% last time. It’s still above the Fed’s 2% target, showing inflation’s stubborn side.

Unemployment: The jobless rate is projected at 4.4% by year-end 2025, a slight nudge up from 4.3% in the prior forecast. The labor market’s holding steady.

What do I think about this?

Personally, I find this short-term bearish but long-term bullish. I’m expecting equities to see a little more headwinds ahead, considering rates are not falling the way most investors expected (although I’ve been saying higher for longer for a while now).

However, the slower pace of QT makes me highly optimistic in the long run, which was a pleasant surprise. Generally, the less QT we have, the more markets can go up and to the right.

I think the Fed’s playing it safe—holding rates steady and easing up on QT to keep the economy humming without letting inflation run wild. Chair Jerome Powell called the outlook “highly uncertain,” hinting at new policies like tariffs as a wild card.

For now, it’s a balancing act: cool inflation, support jobs, and avoid a bumpy landing.

Personal Update 💙

The Final Move in my Permanent Classroom

I finally feel like a real teacher.

The imposter syndrome’s wearing off—maybe because I have a classroom to call my own, or maybe because I’m tenured now. Either way, it feels different. More grounded.

The move was challenging to squeeze in before spring break, but I’m so glad I did it.

I’m excited to decorate. To make it feel like me. Like home.

I’ve always heard stories of teachers who’ve been in the same classroom for decades, and now… somehow, I’m one of them. I’m here until I quit, I’m fired, or I retire. That’s wild.

I’m planning to put up pictures of my family. Hang my degrees. Start a little classroom library with books I actually want my students to read. And, of course, there will be an overly extra coffee and tea station—complete with a distillation setup and fresh ingredients. Because why not?

If I’m going to be there every day, it might as well feel good to be in there.

Taking it Slow for Spring Break

This newsletter is a few days late, but for good reason—I’ve been taking it slow with my family.

Sure, it’s harder to get things done. But maybe that’s the point.

There will probably come a day when I’d give anything to slow down again. To step back into this exact season of life—tiny voices, sticky fingers, the way they gasp at butterflies like it’s the first time, every time.

Since spring break started, my wife and I have been easing into our mornings. We make breakfast together and then put on a little Studio Ghibli while we eat. There’s something about Hayao Miyazaki that has completely captured our attention lately. His stories, his creative process, the tenderness and care behind every detail.

My daughters are absolutely obsessed with Kiki’s Delivery Service. I think we’ve watched it 4 times this week.

My personal favorite? Ponyo.

It’s gentle. A little weird. And beautiful in that way only Ghibli films can be—where everything feels like a dream I once had and forgot about until now.